Why Millions of Americans Are Feeling the Unusual Pressure in 2026-The United States has long been viewed as the world’s most resilient economic powerhouse. From innovation and entrepreneurship to cultural influence and global leadership, America has historically bounced back from crises stronger than before. Yet today, many Americans feel something is different.

Rising prices, housing anxiety, job insecurity, political tension, and global uncertainty have created a sense of strain across households, businesses, and institutions. The question many are asking is simple but profound: why is the U.S. struggling right now?

The answer isn’t one single failure. It’s a convergence of economic pressure, policy trade-offs, global disruptions, and deep structural changes reshaping modern America.

1. Inflation Fatigue: When Everyday Life Gets Expensive

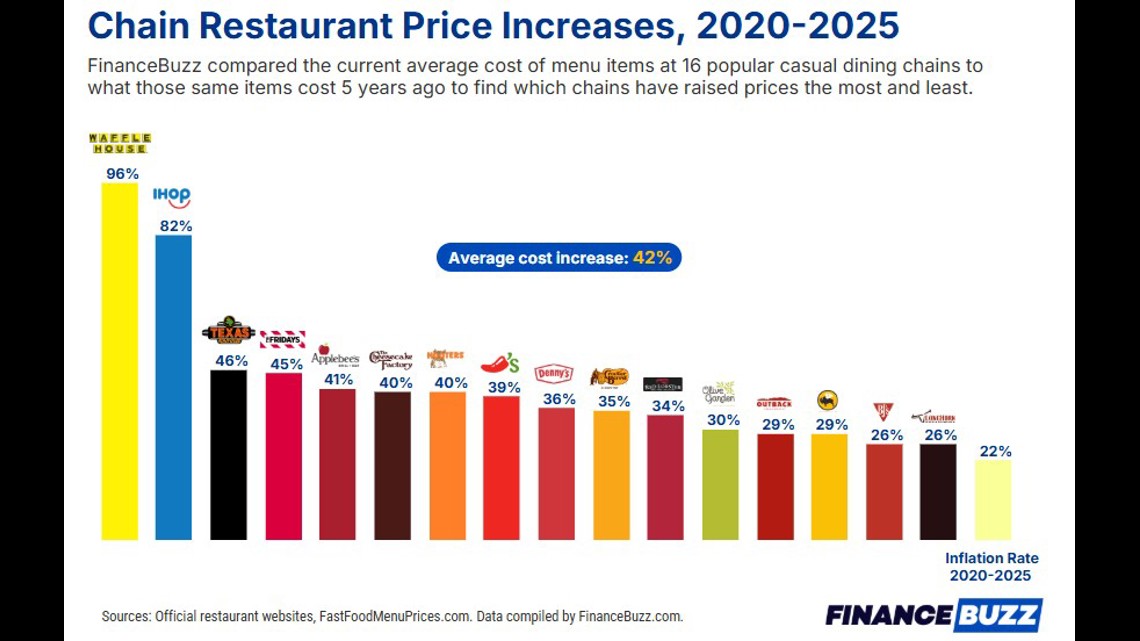

Inflation may no longer dominate headlines daily, but its effects are deeply embedded in American life.

Groceries, rent, insurance, utilities, healthcare, and dining out all cost significantly more than they did just a few years ago. While wage growth exists on paper, many Americans feel their paychecks simply aren’t keeping up.

Inflation impacts more than spending power — it erodes confidence. When families feel unsure about basic expenses, they delay big decisions like buying homes, starting businesses, or having children. This creates a ripple effect throughout the economy.

Even when inflation slows, prices rarely fall back. What Americans are experiencing now is inflation fatigue — exhaustion from adapting to a permanently higher cost of living.

2. Housing Crisis: The American Dream Under Pressure

4

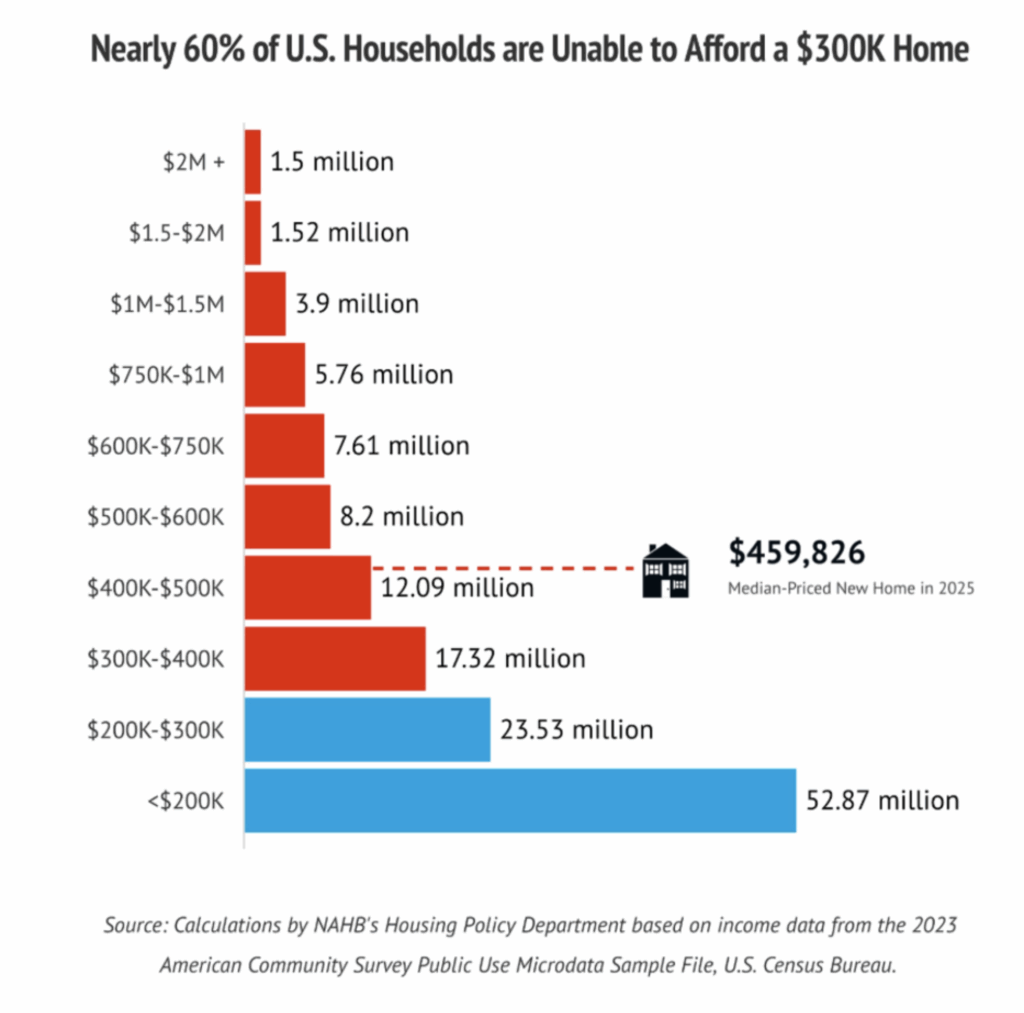

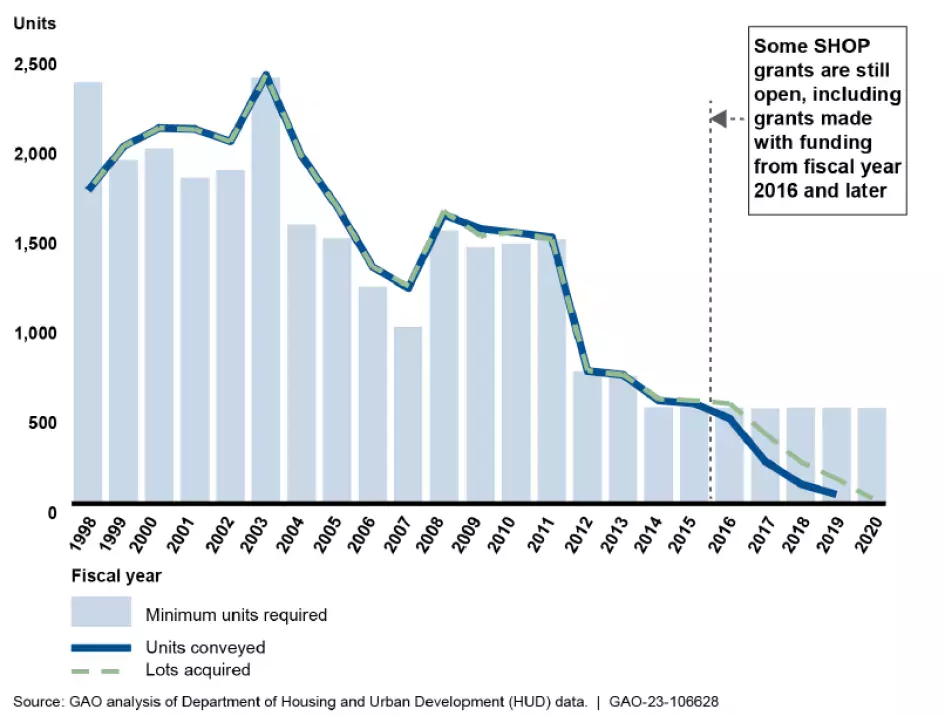

Housing has become one of the most visible stress points in the U.S. economy.

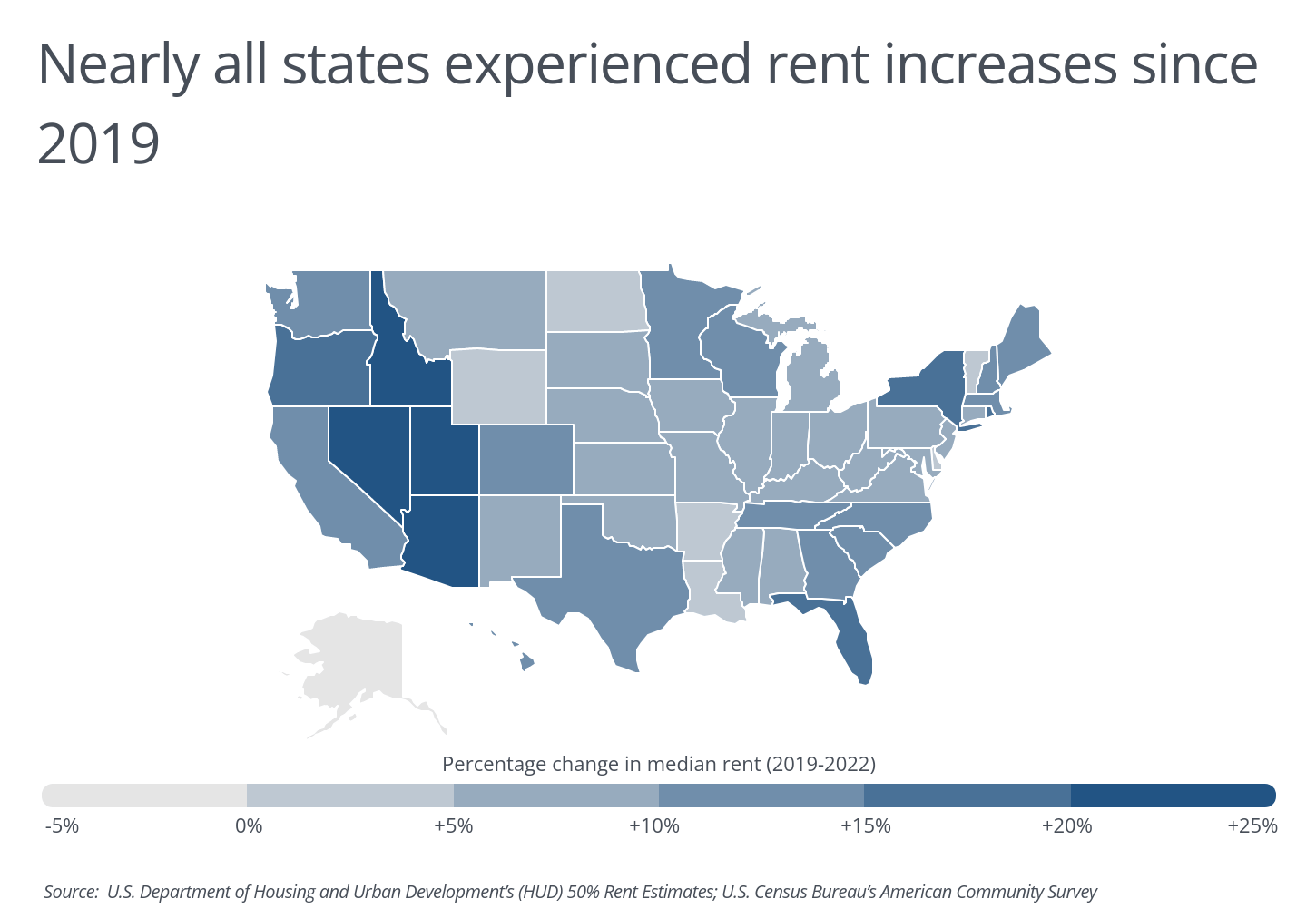

Home prices surged rapidly, while mortgage rates climbed to levels not seen in decades. For many first-time buyers, owning a home now feels out of reach. At the same time, renters face rising monthly costs with little relief.

The supply shortage is a key factor. Years of underbuilding, zoning restrictions, and rising construction costs have left the market tight. Investors purchasing single-family homes have also reduced availability for everyday buyers.

Housing insecurity affects mental health, family stability, and workforce mobility — making it a social issue, not just an economic one.

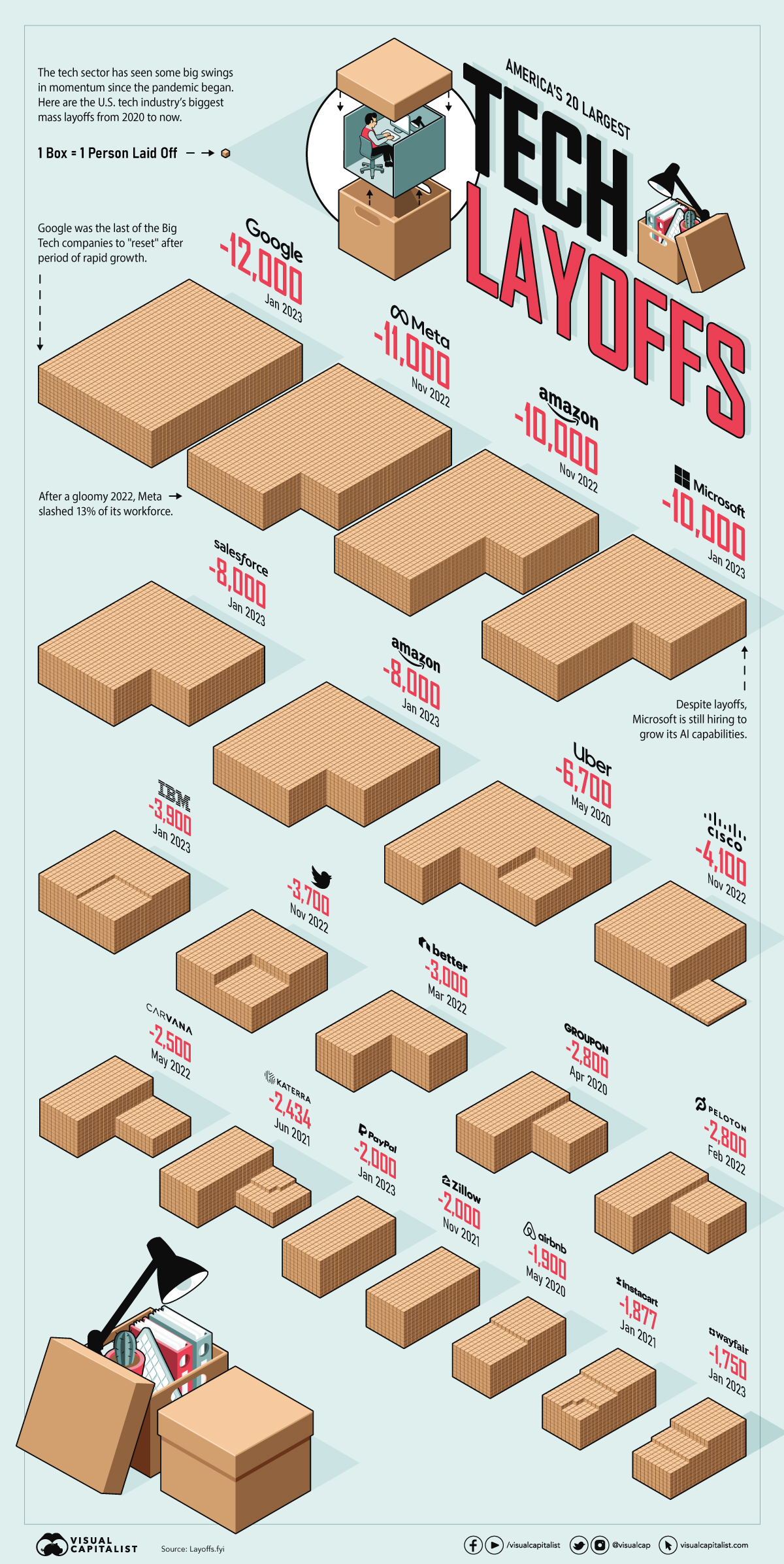

3. Job Market Uncertainty Beneath Strong Headlines

Official employment numbers often suggest stability, but beneath the surface, many workers feel uneasy.

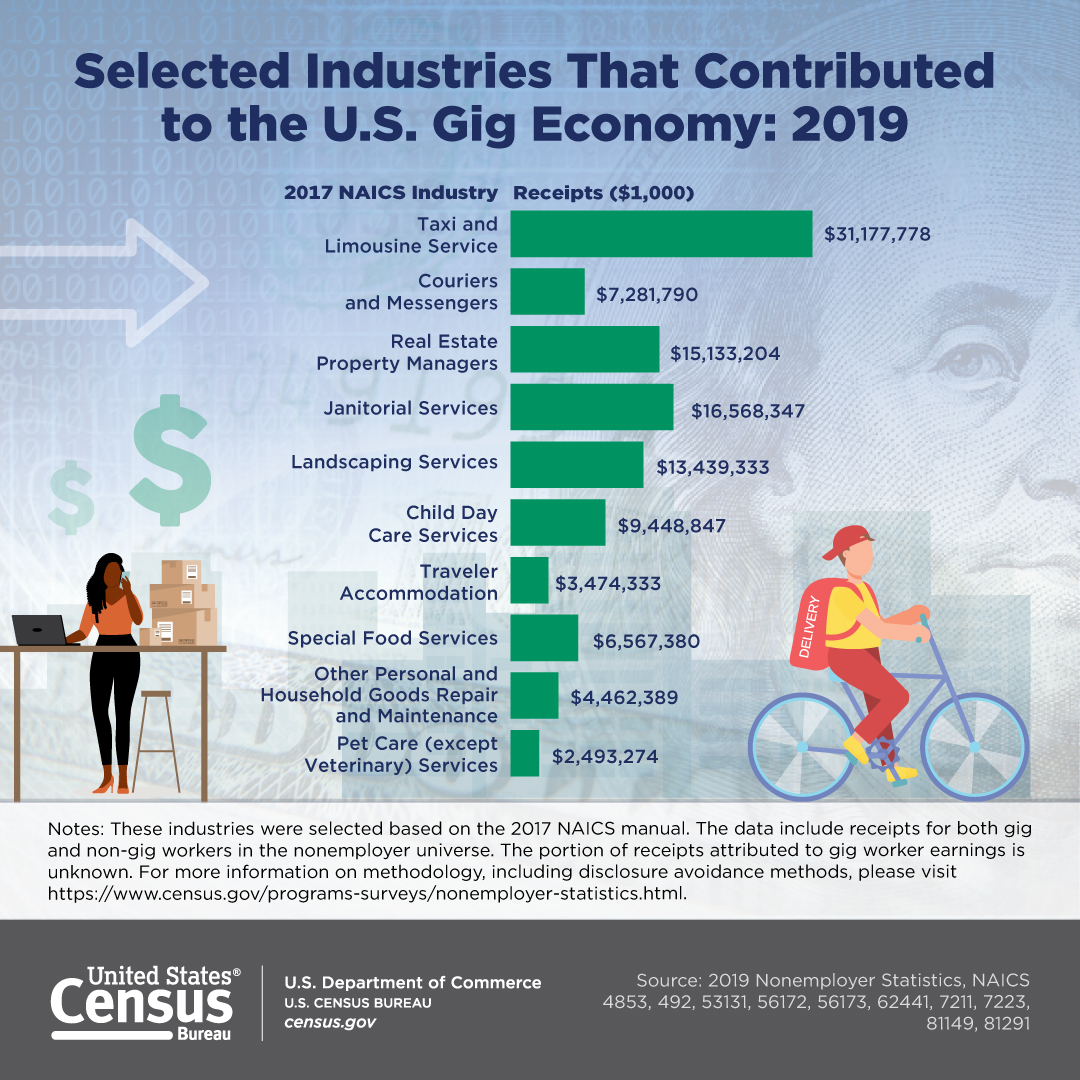

Layoffs in technology, media, finance, and retail have created fear even among those still employed. The rise of contract work and gig-based income offers flexibility, but also reduces long-term security, benefits, and retirement stability.

Workers aren’t just worried about finding jobs — they’re worried about keeping them, adapting to automation, and remaining relevant in an AI-driven economy.

This silent anxiety doesn’t always show up in statistics, but it strongly influences consumer behavior and confidence.

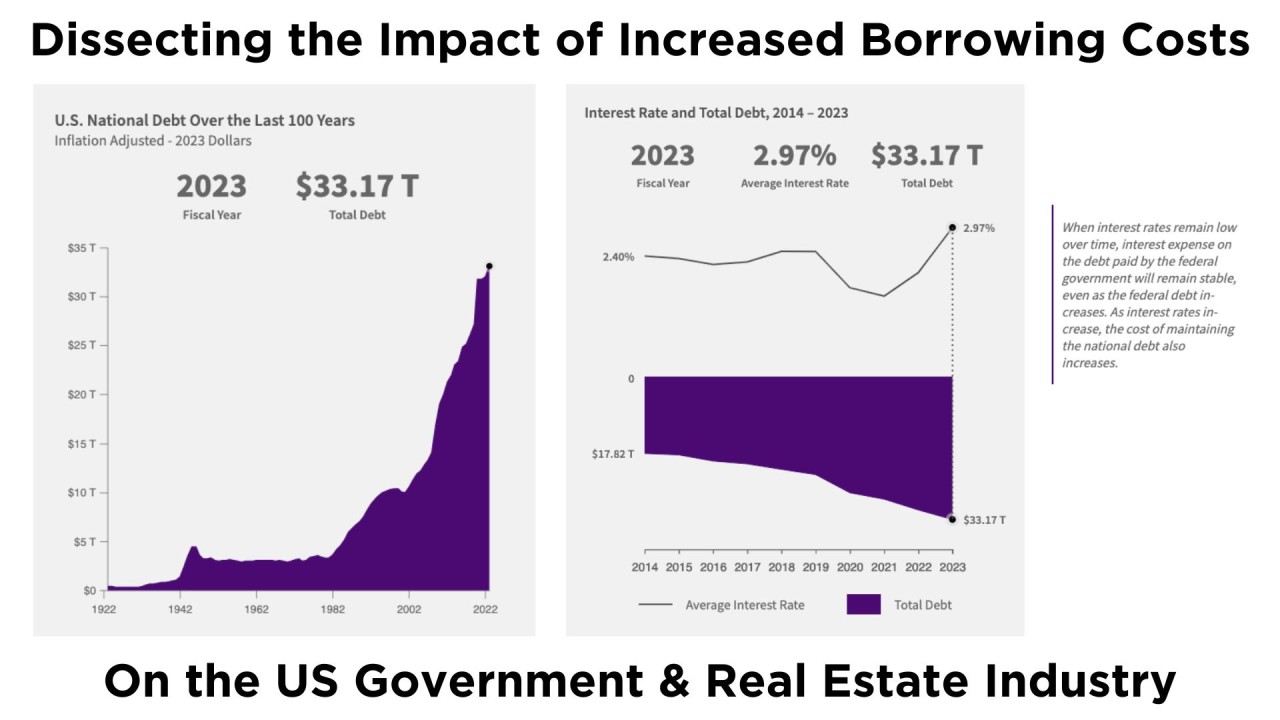

4. Interest Rates and Financial Tightening

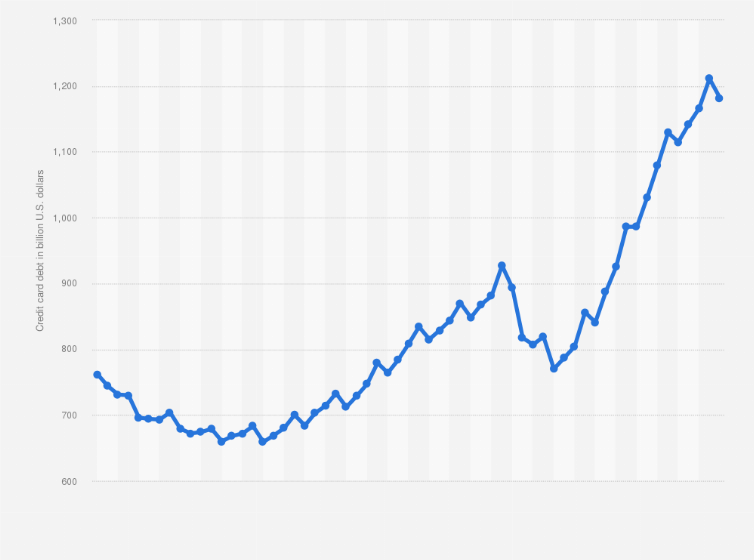

To fight inflation, the Federal Reserve raised interest rates aggressively. While effective in cooling inflation, higher rates have consequences.

Borrowing is now more expensive across the board — from mortgages and car loans to credit cards and small business financing. Consumers carry record levels of credit card debt, and interest charges are cutting deeply into household budgets.

Small businesses, often the backbone of local economies, struggle to expand or even survive under tighter financial conditions.

The result is slower economic momentum and heightened caution.

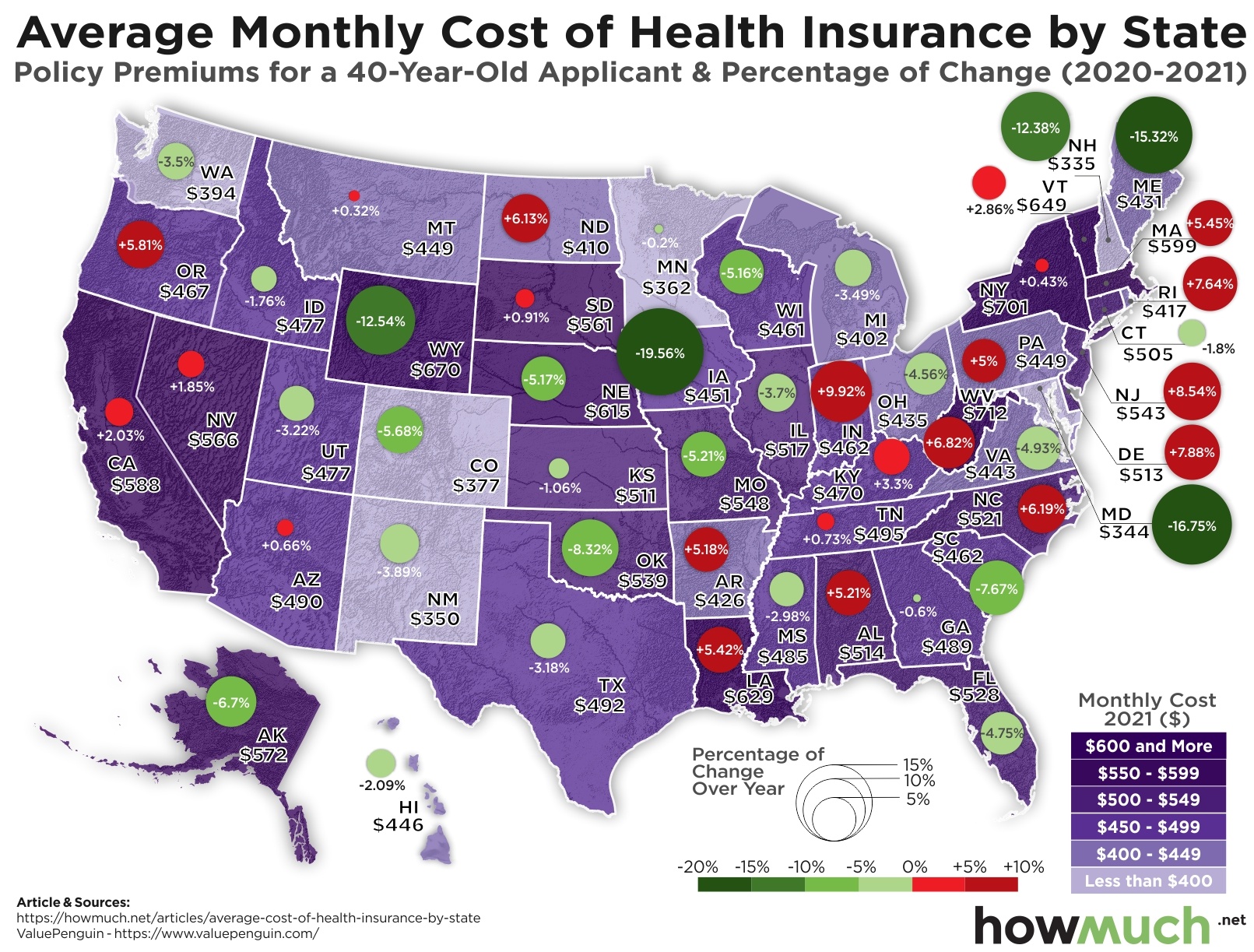

5. Healthcare and Insurance Costs Keep Rising

Healthcare remains one of America’s most persistent financial stressors.

Insurance premiums, deductibles, and prescription costs continue to rise faster than wages for many families. Even insured Americans often delay care due to cost concerns.

This issue affects productivity, workforce participation, and long-term health outcomes — yet solutions remain politically and economically complex.

For many households, healthcare expenses are the single biggest unpredictable financial risk.

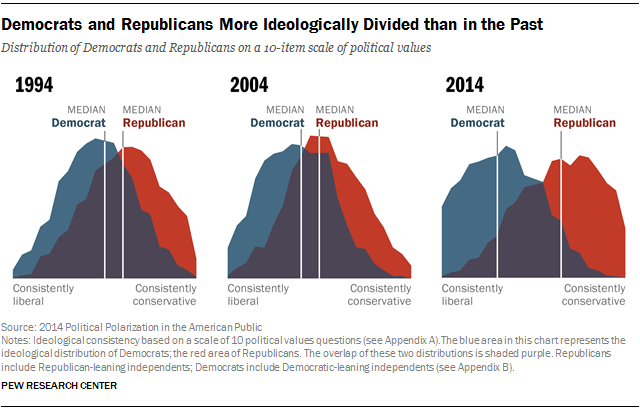

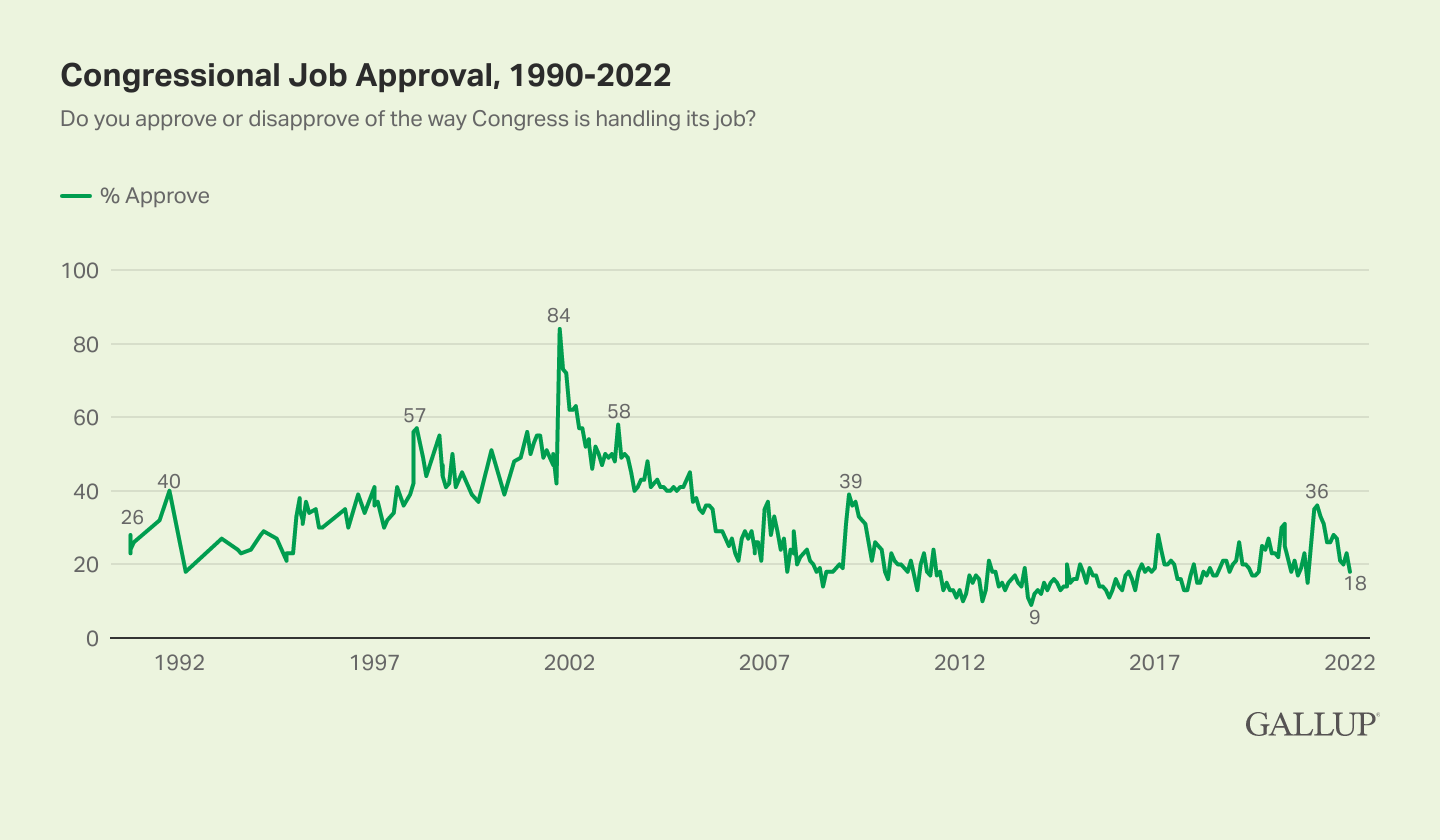

6. Political Polarization and Trust Deficit

Political division has become a defining feature of modern America.

Disagreements over economic policy, immigration, healthcare, climate, and social issues have hardened into cultural identity battles. This polarization makes compromise difficult and slows decision-making at critical moments.

Public trust in institutions — government, media, corporations — has declined sharply. When citizens lose faith in systems meant to serve them, social cohesion weakens.

The result is not just political dysfunction, but emotional fatigue across the population.

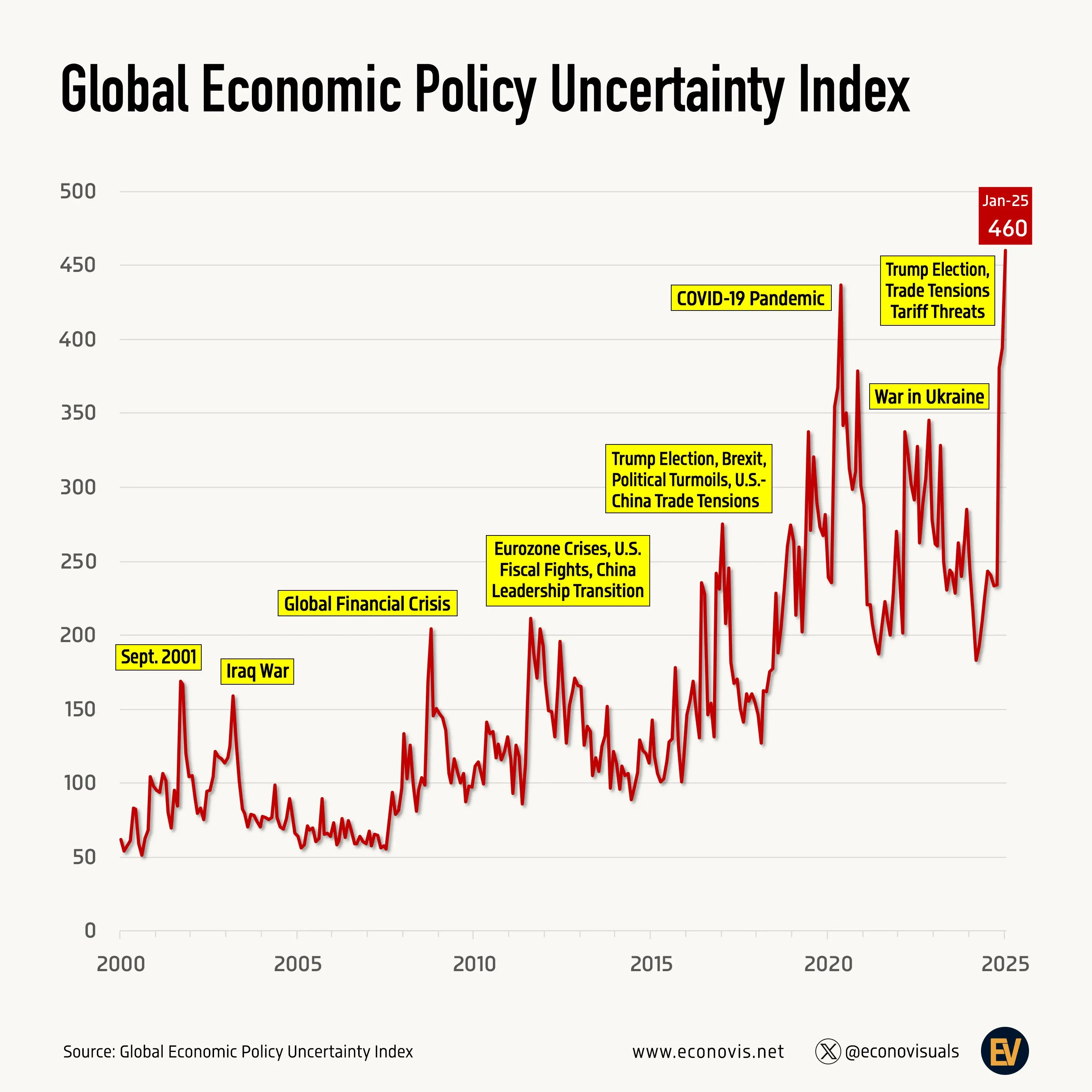

7. Global Pressures and Geopolitical Uncertainty

The U.S. does not operate in isolation.

Ongoing global conflicts, shifting trade alliances, supply chain realignments, and strategic competition with China affect prices, exports, and national security planning.

These pressures increase defense spending, disrupt markets, and create uncertainty for multinational companies and consumers alike.

A more fragmented global economy means fewer easy wins — and higher costs.

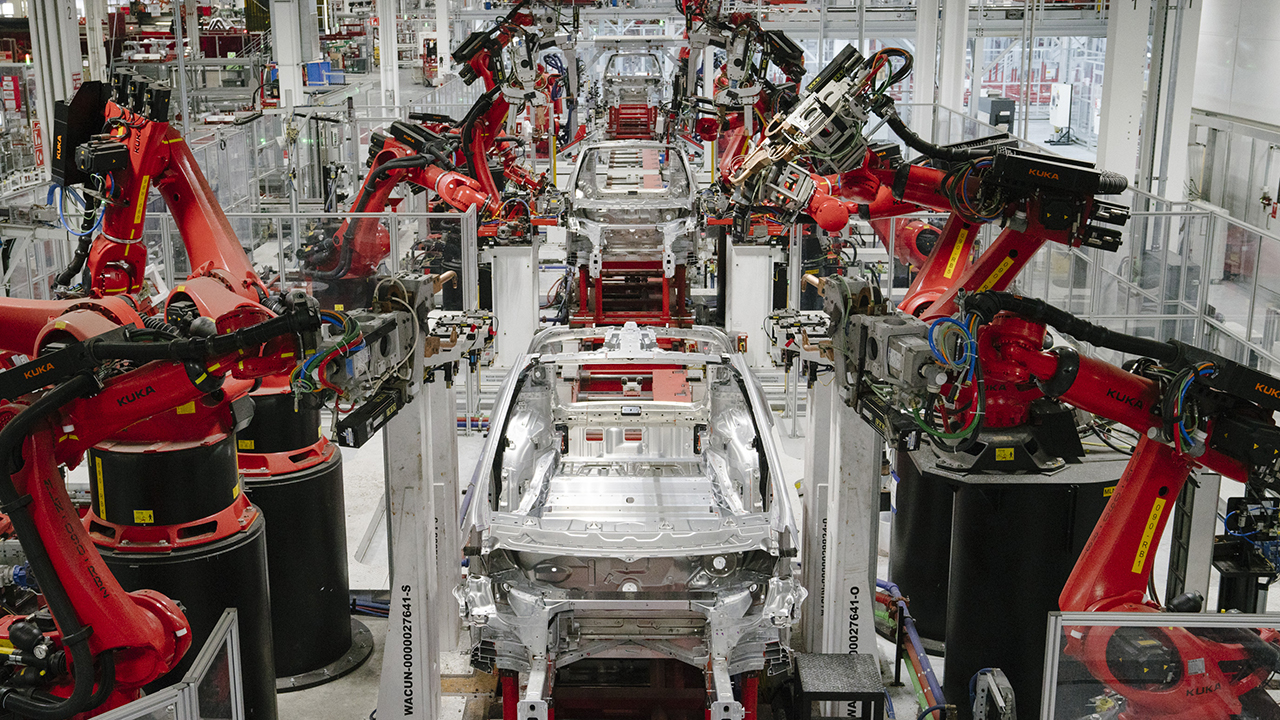

8. Technology, AI, and the Fear of Being Left Behind

Artificial intelligence is transforming industries at unprecedented speed.

While AI brings productivity and innovation, it also creates fear. Workers worry about displacement. Small businesses worry about competition. Regulators struggle to keep pace.

Economic transitions are always disruptive, but the speed of this one feels overwhelming to many Americans.

Change without clear guardrails often breeds resistance and anxiety.

9. Mental Health and Social Strain

Economic stress doesn’t stay in bank accounts — it shows up in mental health.

Rising anxiety, burnout, loneliness, and depression are increasingly discussed across age groups. Social isolation, financial pressure, and digital overload contribute to a sense of exhaustion.

A struggling society isn’t just measured by GDP — it’s measured by how people feel about their future.

10. Is the U.S. Declining or Just Transitioning?

Despite these challenges, it’s important to avoid fatalism.

The United States still leads in innovation, higher education, entrepreneurship, energy production, and cultural influence. Historically, periods of strain have often preceded reinvention.

What America is experiencing may not be collapse — but transition.

A shift toward a new economic model, new technologies, new global roles, and new social expectations.

Transitions are uncomfortable. But they are also opportunities.

Final Thoughts: A Nation at a Crossroads

The U.S. is struggling not because it is weak, but because it is changing under pressure.

Inflation, housing costs, job uncertainty, political division, and global instability have converged at once — testing the resilience of households and institutions alike.

How America responds now — through policy choices, innovation, empathy, and adaptation — will shape the next generation.

History shows that struggle often precedes renewal. The question is not whether the U.S. can recover — but what kind of future it chooses to build.